When we think about government spending and the economy, a common question is, “Can economies or countries choose how much money to give their governments?” In other words, can a country decide the amount of money that flows from citizens and businesses to the government? While it may sound straightforward, there’s a lot to unpack here. Let’s explore how this works, from taxes to government budgeting, to help understand if countries can control this flow of money.

What Does “Giving Money to the Government” Mean?

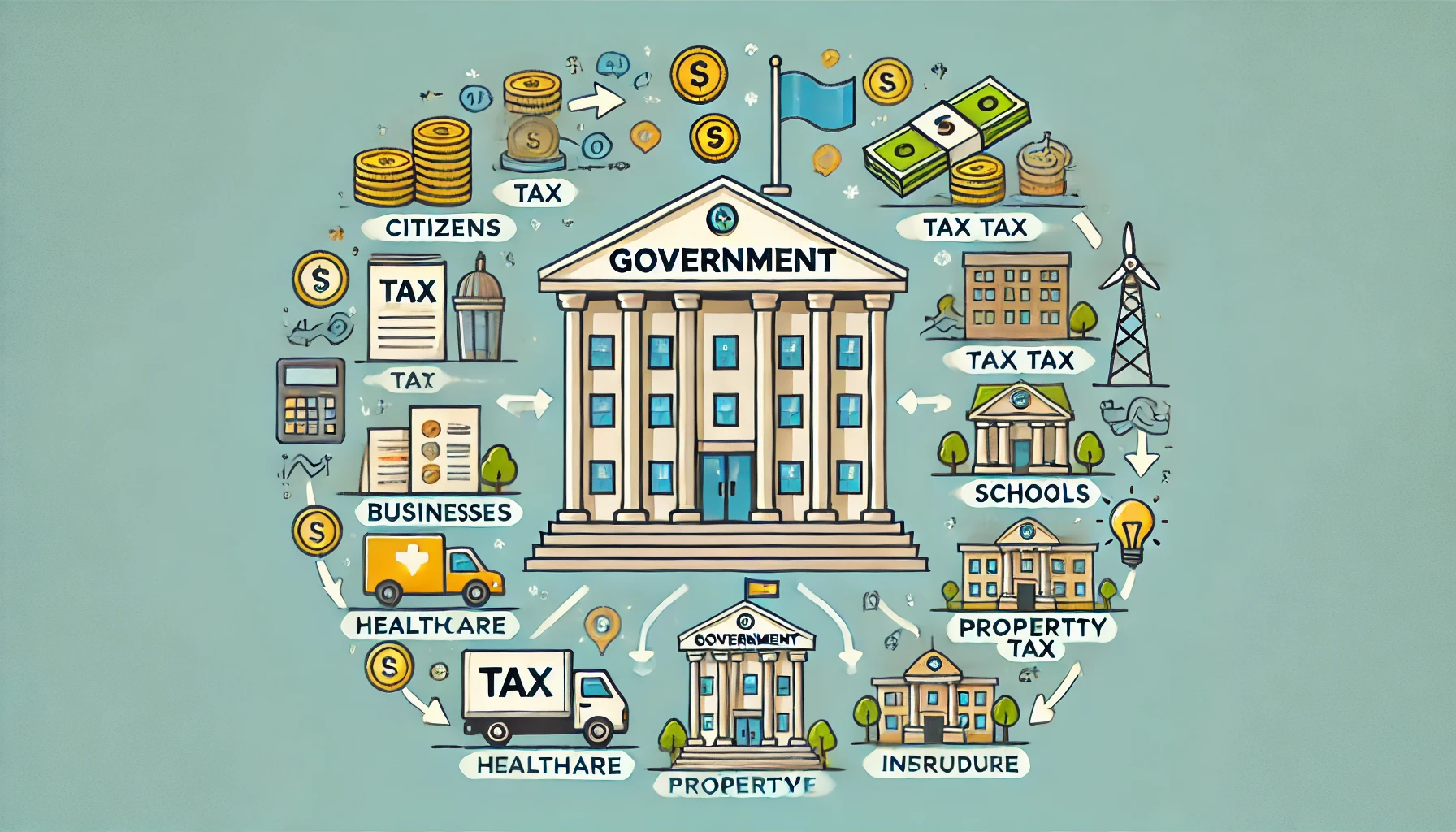

When we talk about giving money to the government, we primarily refer to taxes. Taxes are the money that individuals, businesses, and organizations pay to the government. The government uses these funds to provide services like public education, healthcare, defense, and infrastructure, such as roads and bridges. Governments also rely on taxes to fund social programs that help needy people.

Taxes come in many forms, such as:

- Income tax: Paid on personal earnings.

- Sales tax: Added to the cost of goods and services.

- Property tax: Paid by property owners based on the value of their property.

- Corporate tax: Paid by businesses on their profits.

- Excise tax: Paid on specific goods like alcohol, tobacco, and fuel.

Why Do Economies Pay Taxes?

In general, taxes are seen as the price of living in a community or country that provides services, infrastructure, and security. Imagine if there were no taxes; there might be no roads, no police force, or no public schools. Taxes allow governments to support their citizens and improve the quality of life for everyone.

So, why do economies pay taxes? Here are a few reasons:

- Funding public goods: Governments provide goods and services that benefit everyone, such as public parks and clean water.

- Protecting citizens: Taxes help fund the police, military, and emergency services that protect citizens.

- Supporting the economy: Taxes help pay for infrastructure, which allows businesses to operate efficiently.

- Promoting fairness: Taxes are also used to reduce income inequality by supporting programs for low-income individuals.

Can Economies Choose How Much to Pay?

Governments decide on tax rates based on their needs, the state of the economy, and the policies they want to implement. However, the decision-making process can vary by country and political system.

Democracies and the Power of Choice

In democratic countries, people have a say in how much they want the government to spend and how much they are willing to pay in taxes. This is done through elected representatives who make decisions on behalf of the people. For example, if citizens feel that taxes are too high, they can vote for candidates who promise to lower taxes. If people want more government services, they might support candidates who promise to raise taxes to pay for these services.

Authoritarian Economies and Limited Choice

In countries where the government has more control over economic decisions, like in some authoritarian regimes, people have less say in tax rates and government spending. In these cases, the government often decides how much to tax and spend without input from citizens. This means there is less flexibility for individuals and businesses in these economies to influence how much money they give to the government.

Can Economies Influence How Much Money They Pay?

While individuals can’t directly choose how much tax they pay, they can influence tax policies by voting or participating in the democratic process. Here’s how citizens and businesses can have an indirect say in government spending and taxation:

- Electing leaders: People can vote for leaders who align with their views on taxation and government spending.

- Public protests: Citizens can express their views through protests or public discussions if they feel taxes are too high or services are inadequate.

- Lobbying and advocacy: Businesses and interest groups often lobby government officials to influence tax policies in their favor.

- Tax loopholes: Some companies and wealthy individuals use legal loopholes to reduce their tax burden. This can affect how much money the government collects.

How Governments Decide on Tax Policies

Deciding how much to tax and spend isn’t simple. Governments need to balance collecting enough money to pay for services with not taxing too much, which could harm economic growth. Here are some factors governments consider:

Economic Growth

Governments often adjust tax rates based on the economy. In times of economic growth, they may raise taxes because people and businesses are earning more money and can afford to pay a bit more. During economic downturns, governments might lower taxes to stimulate spending and keep the economy from slowing down too much.

Inflation and Interest Rates

When inflation (the increase in prices) is high, governments might try to reduce spending and borrowing to avoid driving prices up even more. Lowering taxes in times of high inflation can be risky, as it might lead people to spend more, worsening inflation.

Debt and Deficits

Governments often run on a budget deficit, which means they spend more than they collect in taxes. To cover this deficit, they borrow money. When governments take on too much debt, it can cause financial problems and lead to higher taxes or reduced services in the future. Governments often have to balance between collecting enough money in taxes and not running up too much debt.

FAQs About Government Taxation and Spending

1. Can individuals refuse to pay taxes?

No, not legally. While some people try to avoid taxes, doing so can lead to penalties, fines, or even jail time. In most countries, paying taxes is a legal obligation.

2. Why do some countries have higher taxes than others?

Some countries prioritize government services like healthcare and education and thus have higher taxes to fund them. Others have lower taxes but may provide fewer services, leaving individuals to pay for things like healthcare on their own.

3. What happens if a government collects too much money in taxes?

If a government collects more money than it needs, it can either save the surplus for future spending, pay down its debt, or return some of the money to taxpayers in the form of refunds or tax cuts.

4. Are there any countries without taxes?

While there are a few places, like some oil-rich countries, where citizens pay little to no income tax, most countries require some form of tax to pay for services and infrastructure.

5. How do governments decide where tax money goes?

Governments typically create a budget each year, deciding how much money will go to various sectors, such as healthcare, education, defense, and social programs. This budget is usually approved by elected officials.

Conclusion

While individuals and businesses can influence tax policies, they can’t directly choose how much they give to the government. The amount of money that flows to the government is determined by tax rates, which are set by lawmakers based on factors like economic growth, inflation, and government needs. Democracies allow citizens some say in these decisions through voting and public participation. However, in authoritarian regimes, governments have more control over tax policies without public input.

Leave a Reply